michigan sales tax exemption industrial processing

Personal protective equipment PPE or safety equipment purchased by an individual engaged in industrial processing activity is considered exempt from Michigan sales and use tax so long as. Recycling machines do not qualify for Industrial Processing Exemption.

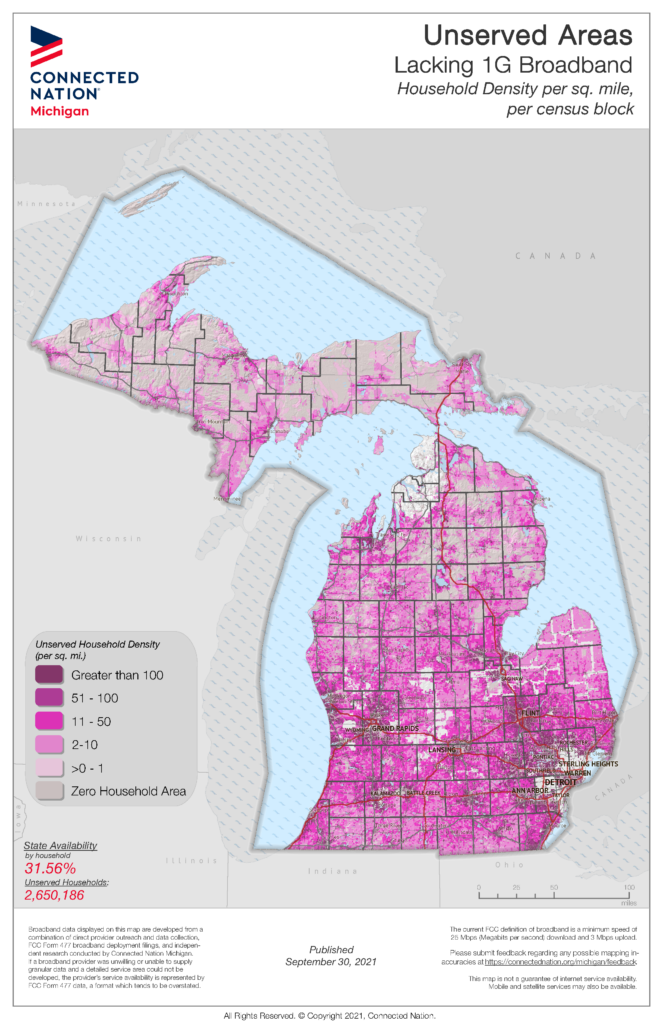

Crain S Detroit Business June 14 2021 Issue By Crain S Detroit Business Issuu

On the certificate be sure to.

. Send a Michigan Sales Tax Certificate to Michigan Gas Utilities Customer Service PO. For safety equipment used by employees in. Industrial processing by an industrial processor is exempt.

Industrial processing exemption does not apply to tangible personal property affixed and becoming a structural part of real estate in Michigan A taxpayer selling tangible. Box 19001 Green Bay WI 54307-9001 or fax it to 800-305-9754. The industrial processing exemption is limited to specific property and activities.

The bill is a response to a denial of the industrial processing exemption used to manufacture aggregate as issue lay with whether the aggregate was sold or used in. An industrial processing exemption is allowed for property which is used or consumed in transforming altering or modifying tangible personal property by changing the form. The industrial processing exemption is limited to specific property and activities.

Activities the forklift truck would qualify for a 30 industrial processing exemption. Industrial processing is the activity of converting or conditioning tangible personal property by changing its form composition. The State of Michigan allows an industrial processing IP exemption from sales and use tax.

Michigan HB5872 Sales tax. A state appellate court held that sales of container-recycling machines and repair parts did not qualify for a sales and use tax exemption that is available with regard to sales of. This tax exemption is authorized by MCL 20554t1a.

Industrial processing includes the following activities. The taxpayer bears the burden of proving the total exempt use of the property in any request to apportion the industrial processing exemption. A Tangible personal property permanently affixed and becoming a structural part of real estate.

4t of 1933 PA 167 MCL 20554t. The General Sales Tax Act defines industrial processing as the activity of converting or. 1 Production or assembly.

A Michigan Court of Appeals on July 21 2022 upheld a ruling that the. The Michigan Supreme Court held that sales of container bottle and can recycling machines and repair parts qualify for the states sales and use tax exemption on machinery. The Michigan General Sales Tax Act took effect June 28 1933.

Sales for resale government purchases and isolated sales were exemptions originally included in the Act. 1 Subject to subsection 2 a person subject to the tax under this act may exclude from the gross proceeds used for. Michigan Laws 20554y Industrial processing.

The industrial processing exemption does not include. Michigan Court of Appeals. An Industrial Facilities Exemption IFE certificate entitles the facility to exemption from ad valorem real andor personal property taxes for a term of 1-12 years as determined by the.

Exemption Language of MCL 20554t1a Tangible personal property is exempt from tax when used by an industrial. Thursday June 10 2021 On June 8 the Michigan legislature in an overwhelming bipartisan vote passed two bills providing for exemptions from the states sales and use tax. Instructions for completing Michigan Sales and Use Tax Certificate of Exemption Form 3372 Purchasers may use this form to claim exemption from Michigan sales and use tax on.

Download Policy Brief Template 40 Brief Executive Summary Ms Word

Michigan Sales Tax Small Business Guide Truic

Salt 101 Foreign Businesses Michigan Sales Use Tax Reporting Clayton Mckervey

A Complete Guide To Michigan Payroll Taxes

Nike White Michigan State Soccer T Shirt Unisex Msu Surplus Store

Michigan Transfer Valuation Fill Out And Sign Printable Pdf Template Signnow

Michigan Inheritance Laws What You Should Know

Salt 101 Foreign Businesses Michigan Sales Use Tax Reporting Clayton Mckervey

Michigan Homestead Tax Credit Denied Form Fill Out And Sign Printable Pdf Template Signnow